san francisco sales tax rate july 2021

The December 2020 total local sales tax rate was 8500. Method to calculate San Francisco sales tax in 2021.

California City County Sales Use Tax Rates

This is the total of state county and city sales tax rates.

. Free Unlimited Searches Try Now. The 8625 sales tax rate in San Francisco consists of 6 California state sales tax 025 San Francisco County sales tax and 2375. This is the total of state county and city sales tax rates.

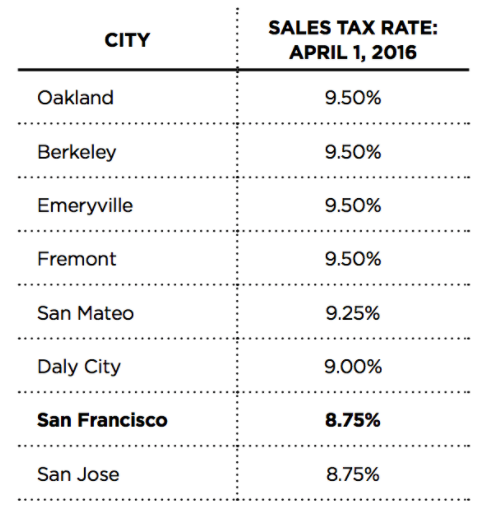

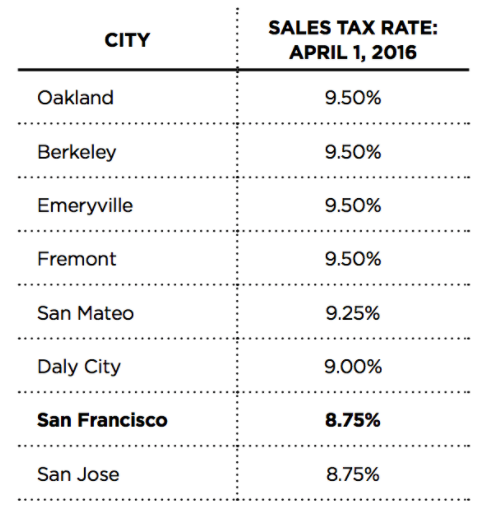

The Sales and Use tax is rising across California including in San Francisco County. 2 Four states tie for the second-highest statewide rate at 7 percent. From there go to the.

This is the total of state county and city sales tax rates. The current total local sales tax rate in San Francisco County CA is 8625. Most of these tax changes.

The new rates will be displayed on July 1 2021. 0875 lower than the maximum sales tax in CA. The South San Francisco California sales tax rate of 9875 applies to the following two zip codes.

As we all know there are different sales tax rates from state to city to your area and everything combined is the required. What is the sales tax rate in San Francisco California. July 1 2021 Sales Tax Rate Changes.

The San Francisco County sales tax rate is. San Francisco CA Sales Tax Rate. The minimum combined sales tax rate for San Francisco California is 85.

How much is sales tax in San Francisco. The California sales tax rate is currently 6. The County sales tax rate is.

The 2018 United States Supreme Court decision in South Dakota v. An alternative sales tax rate of 9875 applies in the tax region Daly. The current total local sales tax rate in San Francisco CA is 8625.

As we all know there are different sales tax rates from state to city to your area and everything combined is. Find a Sales and Use Tax Rate by. Tax Rate and then select the Sales and Use Tax Rates.

The minimum combined sales tax rate for San Francisco California is 85. The December 2020 total local sales tax rate was 8500. Method to calculate Presidio San Francisco sales tax in 2021.

All rates are General Retail Sales or Use tax rates and do not reflect special category products or particular industry rates. In San Francisco the tax rate will rise from 85 to 8625. Ad Get California Tax Rate By Zip.

Webpage and select. It was raised 0125 from 85 to 8625 in July 2021 raised 0125 from 85 to 8625 in July 2021 raised 0125 from 925. 1788 rows California City County Sales Use Tax Rates effective April 1.

California City County Sales Use Tax Rates. In San Francisco the tax rate will rise from 85 to 8625. Has impacted many state nexus laws and sales tax collection.

The minimum combined 2022 sales tax rate for San Francisco California is.

How Low Taxes Lead To High Home Prices In Vancouver Bc Sightline Institute

How High Is Georgia S Corporate Tax Rate Atlanta Business Chronicle

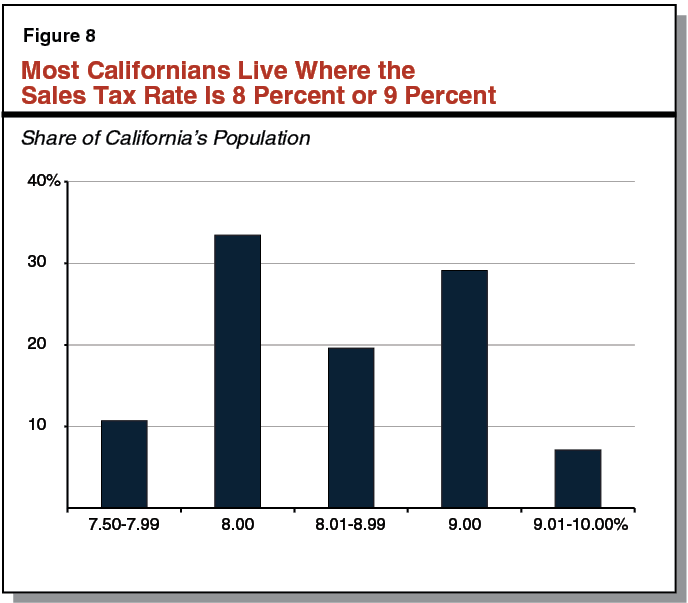

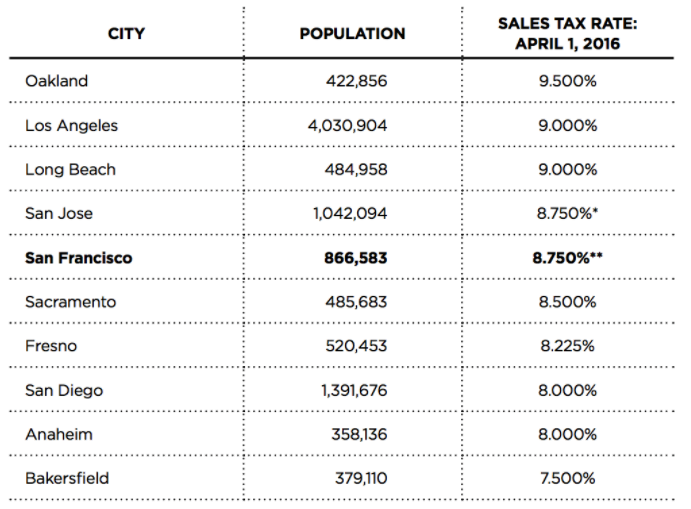

Understanding California S Sales Tax

California Sales Tax Small Business Guide Truic

San Francisco Prop K Sales Tax For Transportation And Homelessness Spur

California Sales Tax Rates By City County 2022

California Sales Use Tax Guide Avalara

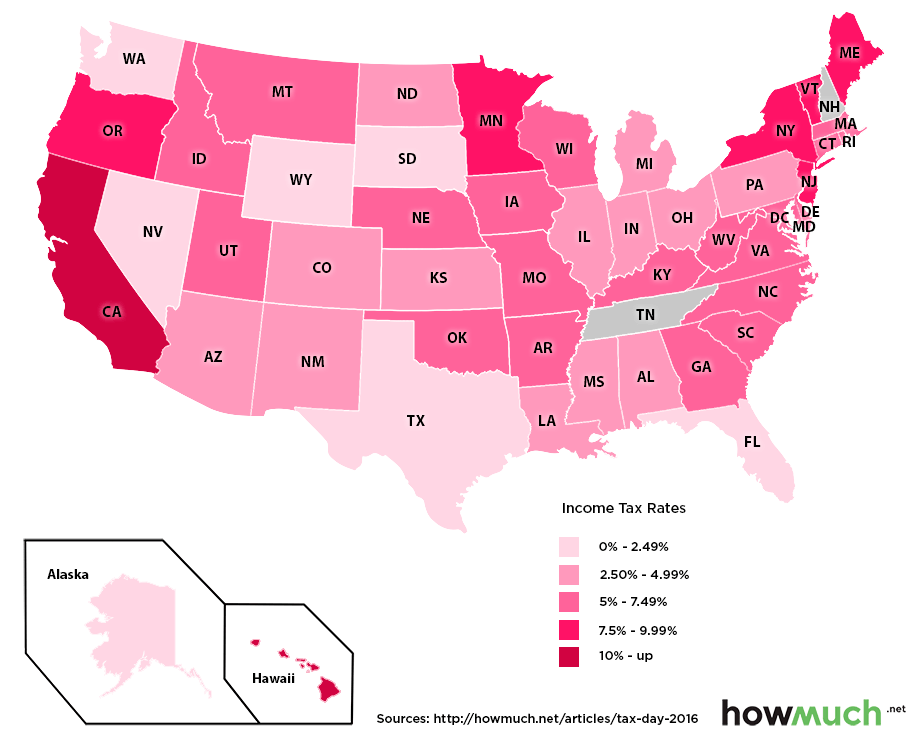

Which U S States Have The Lowest Income Taxes

San Francisco Prop W Transfer Tax Spur

Opinion Why California Worries Conservatives The New York Times

Understanding California S Sales Tax

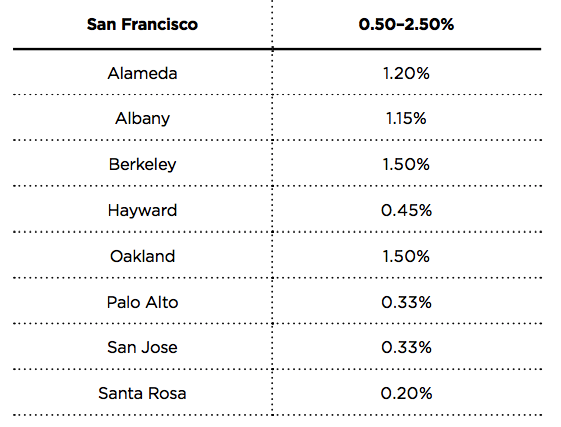

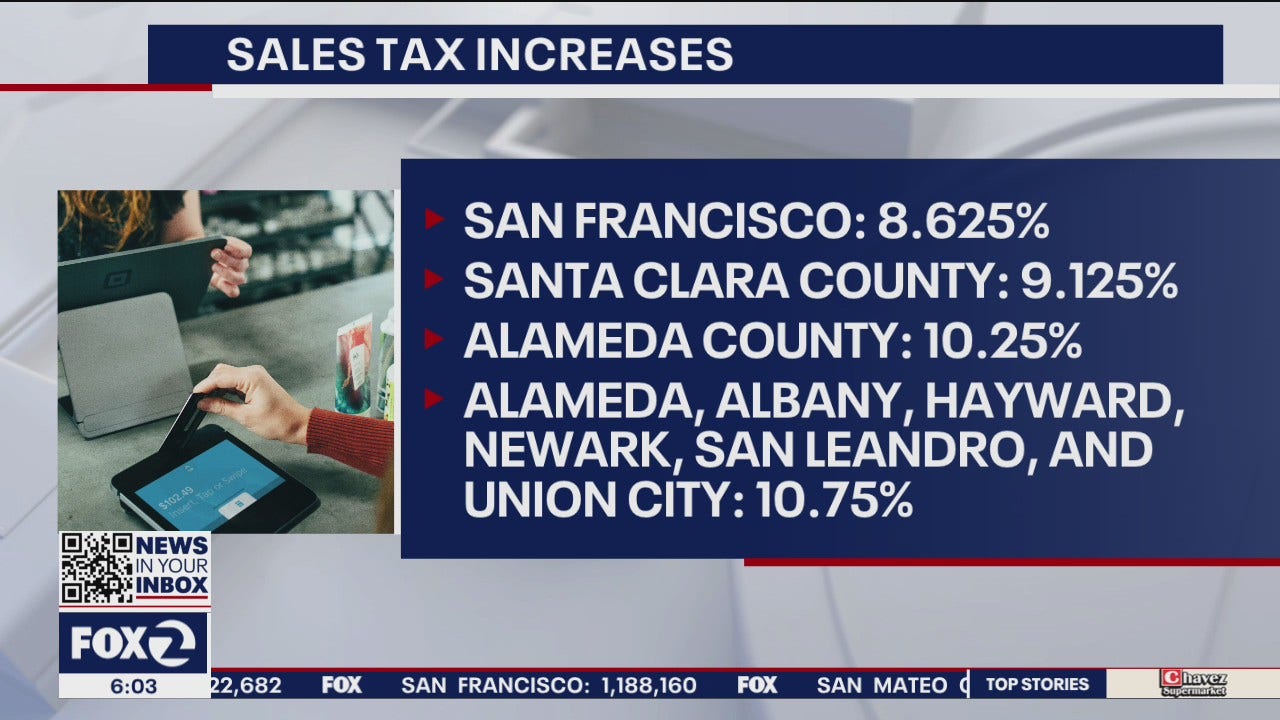

Sales Gas Taxes Increasing In The Bay Area And California

2022 Federal State Payroll Tax Rates For Employers

Understanding California S Sales Tax

San Francisco Prop K Sales Tax For Transportation And Homelessness Spur